A Commercial Bank's Has Actual Reserves of $1 Million

We also know that the reserve ratio is 10 percent. A commercial banks reserves are.

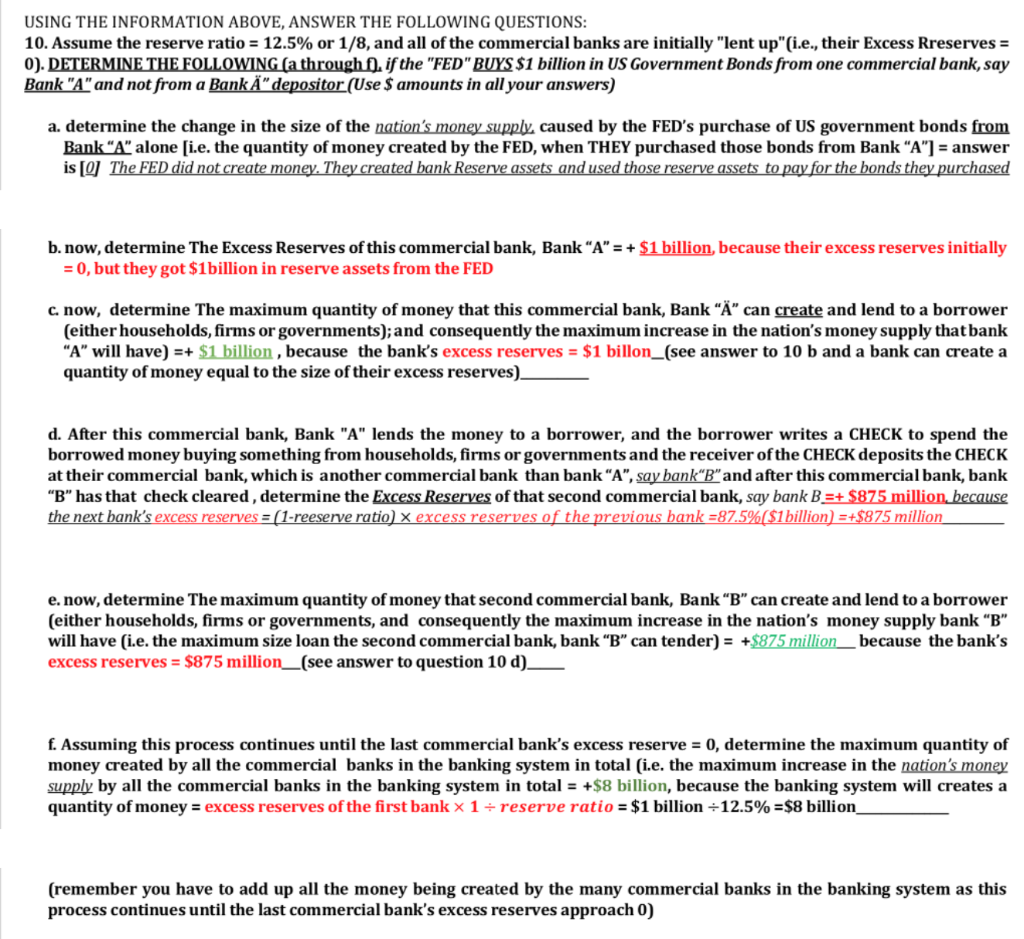

Please Do All Of Them Explain Telling What Chegg Com

Thus the bank can safely.

. The excess reserves of the bank are. The required reserve ratio is 5 percent. Assume that the required reserve ratio is 5.

If a commercial bank has 2 million cash in its vault 1 million in government securities 3 million on deposit at the Fed and 60 million in checkable deposits then its excess reserves equal. Suppose a commercial bank has a target reserve ratio of 1 but has an actual reserve ratio of 08. A commercial bank has actual reserves of 1 million and checkable-deposit liabilities of 9 million and the required reserve ratio is 10 percent.

Ch 17 When 1 million is deposited at a bank the required reserve ratio is 20 percent and the bank chooses not to hold any excess reserves but instead makes loans then in the banks final balance sheet B. We can then compare this result to the 12 million in actual reserves and find the excess. A commercial bank has 100 million in checkable-deposit liabilities and 12 million in actual reserves.

The excess reserves of the ban are. Which of the following are reported as liabilities on a banks balance sheet. If a bank has demand deposits of 4 million and actual reserves of 1 million it can safely lend out.

We can then subtract this amount from the actual reserves. The required reserves 3 million The total reserves are the amount in the vault and the deposits at the fed. A bank has excess reserves of 5000 and a deposit liabilities of 50000 when the required reserve ratio is.

Reserves increase by 200000. We can substitute the given values into the formula to find the commercial banks required reserves. The excess reserves of the bank.

A commercial bank has 2 million cash in its vault 1 million in government securities 3 million on deposit at the Fed and 60 million in checkable deposits. The required reserve ratio is 10 percent. A 10000 B 50000 C 250000 D 1 million 12.

Suppose the reserve requirement is 20 percent. Asked Aug 11 2018 in Economics by Stasha. If a bank has actual reserves of 40000 and a 20 percent reserve requirement then the maximum amount of checkable deposits the bank can have if excess reserves are zero is.

Liabilities to both the commercial bank and the Federal Reserve Bank holding them. McConnell - Chapter 15 23 Topic. This banks _____ isare 75 million.

A commercial bank has 100 million in checkable-deposit liabilities and 12 million in actual reserves. A commercial bank has actual reserves of 1 million and checkable-deposit liabilities of 9 million and the required reserve ratio is 10 percent. A commercial bank has actual reserves of 1 million and checkable-deposit liabilities of 9 million and the required reserve ratio is 10 percent.

How big are the banks excess reserves. A commercial bank has excess reserves of 5000 and a required reserve ratio of 20 percent. How big are the banks excess reserves.

A Single Commercial Bank 24. This bank will likely. So the total reserves are 5.

The required reserve ratio is 10 percent. If the reserve requirement is 20 a bank has checkable deposits of 4 million and actual reserves of 1 million. The commercial bank has 10 million in required reserves.

It makes a loan of 6000 to a borrower. LO332a100 millionb88 millionc12 milliond2 million. A commercial bank has actual reserves of 1 million and checkable-deposit liabilities of 9 million and the required reserve ratio is 10 percent.

The excess reserves of the bank are. If it receives 5000 in cash from a depositor and the bank finds that it can safely lend out 4500 the reserve requirement must be. What is the amount of required reserves.

If a bank has checkable deposits of 4 million and actual reserves of 1 million it can safely lend out. Reserves increase by 200000. The excess reserves of the bank are.

A Single Commercial Bank 24. If a bank has checkable deposits of 4 million and actual reserves of. Chapter 15 - Money Creation 25.

Asked Sep 8 2019 in Economics by Wayuvan. Suppose a commercial bank has a level of target reserves of 500 million and actual reserves of 575 million. The actual reserves of the bank are given to be 1 million which means the bank has excess reserves of 200000 actual reserves - required reserves.

Liabilities to the commercial bank and assets to the Federal Reserve Bank holding them. A commercial bank has checkable-deposit liabilities of 50000 and a reserve ratio of 20 percent. The required reserves for this bank will be 20 of 4 million which is 800000.

A commercial bank has actual reserves of 1 million and checkable-deposit liabilities of 9 million and the required reserve ratio is 10 percent. A commercial bank has actual reserves of 1 million and a checkable-deposit liabilities of 9 million wile the required reserve ratio is 10.

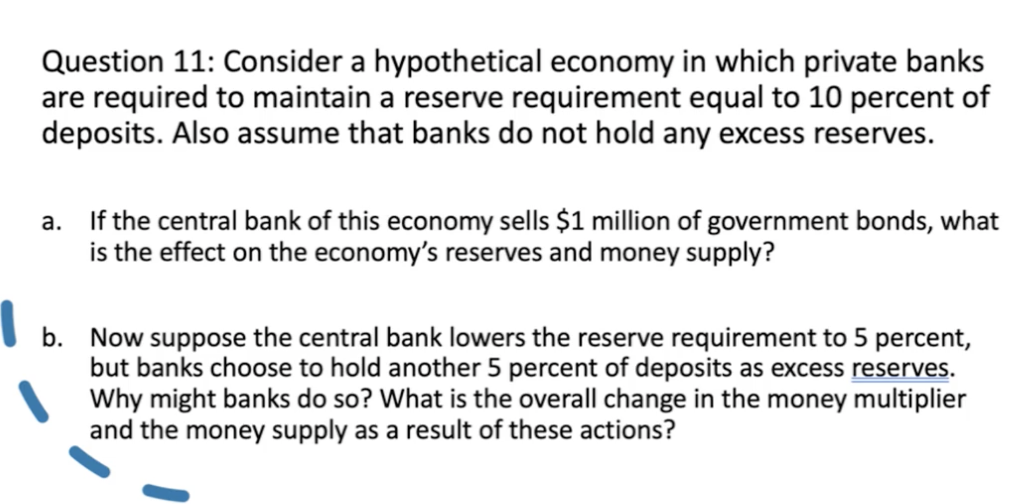

Solved Question 11 Consider A Hypothetical Economy In Which Chegg Com

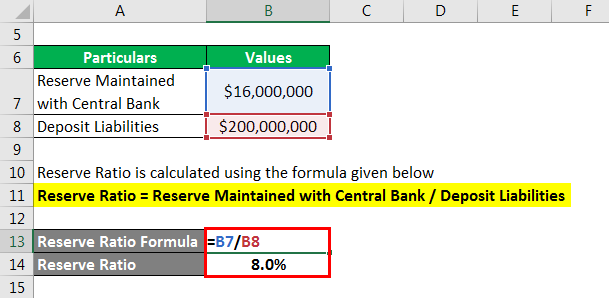

Reserve Ratio Formula Calculator Example With Excel Template

/dotdash_Final_Reserve_Ratio_Definition_Oct_2020-01-abeb9a9e7e894fddbbbf82dc746152f5.jpg)

0 Response to "A Commercial Bank's Has Actual Reserves of $1 Million"

Post a Comment